On Sunday night, I launched jobordole.com, a simple calculator that tries to work out if you’d be better off working or on the dole. This was all inspired by an article about two people being offered a job at €28K and refusing it because they were better off on the dole. I don’t know much about the ins and outs of claiming anything from welfare, so I decided to educate myself and see if this was true (as I suspected it wasn’t).

I’ve been getting traffic today from a blog called ‘Progressive-Econonomy@TASC‘ where there was a post by Michael Taft called ‘A life of luxury on the dole‘. The post takes issue with how I’ve made my calculations and the language I use. Since I’ve been responding to people on forum threads, I’m going to do the (unusual for me) step of responding here to his criticisms.

First off, he’s reading far, far too much into how I phrased things. I used ‘you could get‘ for the dole part as your means tested and the value displayed only the possible maximum amount. To make this clearer, I’ve changed it to ‘The maximum you could be entitled to‘.

I used ‘ You get’ for a person’s pay as if you are paid, the figure is far firmer. I can determine’s a persons take home pay with far greater accuracy as a large chunk of the variables are already known. It also could be because I work so automatically think of myself in these situations. But that would be reading far, far too far into a throw away sentence written around a far more important value.

On to his first proper complaint – Family Income Support. This is a fair complaint and I’ve included it in the calculation. However, for the example at hand, the mythical job refuser would still get more on the dole (€15.81) so my calculations are still valid. I’ve added a few links to the FIS information on welfare and fingers crossed, one of the many people who don’t claim it will see it and start benefiting.

The second part of the argument if about the rent supplement. I found the numbers on how many people are actually receiving the supplement to be extremely interesting (and far lower than I would have guessed). However, just because only 13.5% of those on Jobseekers Allowance get it doesn’t invalidate my calculator. As he points out, one of my assumptions is that you do get it. If you know you don’t or wouldn’t get the rent supplement you can easily see from my breakdown that it’s not worth refusing a job. It is a key factor and I make no apologies for using it in the calculator. I have added the stat to my assumptions so people are clear that there’s only a slim chance of receiving it.

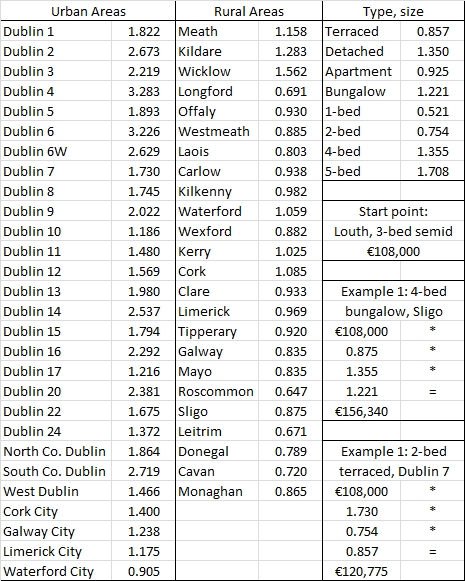

On to the number I picked for the rent. It is the maximum and it was picked so the example would get the maximum possible rent supplement. On the contention that the Daft report says the average rent in Dublin is €993, I can’t see that figure directly (and I’m too lazy to add the number for the various Dublin areas myself). What I do see is that the rents in the Dublin area can range from €850 to €1,284 so while €930 is at the bottom end of the range, it is still within the average rent. Also, the prices used in the Daft report are the displayed price and not the price a property was rented at. My own (and many friends and acquaintances) experience is that at the moment the asking price is only a start and places are rented for much lower. However, anecdotes are not evidence so we’ll go with the Daft figures. 10 of the 24 areas have average rents under €930 so I don’t think it unreasonable that a family could get a two bed at that price. A quick search on Daft for 2 beds under €1000 (since you can’t pick €930 exactly) throws up a number of properties for or under our magic €930 (which will accept the all important rent allowance).

The next part of the complaint is that €930 is higher than you’re allowed elsewhere. This is true, and I don’t hide that fact. The table listing all the maximum rents allowed in each area is made available via the link entitled ‘Show/hide a list of the limits.’. Our example family though lived in Dublin so it’s not going outside of the parameters. Going on then about the different limits without changing the example is moving the goalposts somewhat. I’m making a claim about a very particular set of circumstances. It’s easy to plug in numbers for the other areas and see if the same results come out in favour of taking the dole (not at all).

I’m not claiming that everyone gets €191 a week in rent allowance. It is worked out individually for each set of numbers put in. The figure of €191 only applies if you are paying exactly €930 a month in rent. It’s disingenuous to imply (as is done in the paragraph about the average received) that the calculator always assigns this amount. If you do take the average of €106 for rent allowance, then you’d need to earn over €20K before a job become more financially rewarding.

So at the end of this, my contention and calculation still stands – if you live in Dublin, have a spouse and dependant child and if you are entitled to rent allowance (and get the maximum allowed of €930), you are better off on the dole. All that Michael Taft’s post has done is put meat on the bones and tell you how likely it is for the conditions to be right (which, in fairness, is very much worth doing).

What bugs me a bit is that Mr. Taft didn’t bother to scroll a little further beyond the assumptions and click on the contact me link and get in touch. I’m always open to suggestions on improvements and I’ve been keeping an eye on a couple of threads where the site has been mentioned to see if there’s anything I can easily add. I found out about the post from my access logs, a mention in a thread and an e-mail from a randomer who likes the idea but thinks I should improve it.

As a final parting shot, I take issue with the post title. I’m not saying a person should go on the dole because it’s all sweetness and light and fun for all the family. I am merely pointing out in some very specific situations a person couldn’t be blamed for turning down a job as they would end up financially worse off. In fact, most of the time the calculator shows that people should get (or stay in) a job. There’s plenty of other reasons to take a job but if a family is struggling in the current harsh climate, can we really blame them for picking the financially sounder option?

I will certainly not be taking down the site but I am open to comments on how to improve it. Thanks for the traffic, in this economy every little helps.